Wills and trusts are legal documents that give a person control over who will receive the person’s assets after his or her death. Wills become public record during a probate proceeding because they are filed with the probate court after death. There is also an inventory of the deceased person’s assets filed with the court. This makes public everything the deceased owned. Trusts are private documents. Neither the trust nor an inventory is filed with the court. The trustee distributes the trust assets to the beneficiaries without any court supervision. Trusts can be used to reduce estate taxes, manage and protect assets from creditors, and avoid probate. A married couple may establish a joint trust.

Living Will

A living will is not used to transfer assets. The purpose of a living will is to direct your health care provider about the types of medical treatment you want to receive when you are incapacitated or unable to make your own decisions.

Revocable Trusts

A revocable trust is a legal document that functions like a trust but is completely private. Also, unlike a will, a trust takes effect when it is created. If you become incapacitated, the trust allows your successor trustee to manage your estate and take care of your financial affairs without a probate court supervised conservatorship.

With a revocable trust, your assets are transferred and held in the name of your trust. So if you own property under the name of Bill Jones, you would transfer title of the property to Bill Jones, Trustee of the Bill Jones Trust. The assets can be transferred back at any time, and the trust can be terminated whenever you wish. After your death, the assets owned by the trust are given to the beneficiaries in accordance with the trust directions, and the beneficiaries avoid the expense and time of having to go through a formal court probate proceeding.

If you become ill or incapacitated your trust names a successor trustee to manage the assets. Assets in a revocable trust may not be protected from creditors and are included as part of the value of your estate at death. They are also subject to Federal Estate Tax laws.

Irrevocable Trust

An irrevocable trust is usually used to reduce estate taxes and protect assets against creditors. In an irrevocable trust, the assets are transferred to the trust, and you no longer have control of them. The assets cannot be taken out and transferred back to you, and the trust cannot be changed.

Under current law, estates valued at $5,400,000 or less are exempt from paying federal estate taxes. This number is annually indexed for inflation. There are currently no California estate taxes.

It is important to understand how wills and trusts work and the purposes of each in order to make financial and health care decisions. It is recommended that you speak with a California probate and estate attorney before making a will and/or trust. The attorney will discuss the different estate planning options and recommend the best ones for your particular financial situation. Please feel free to call our office at 858-792-5988 for a consultation.

I have a trust. So I still need a will?

Yes. Even if the bulk of your estate planning instructions are in a revocable living trust, you still need a will. Your will appoints guardians for minor children, names your executor, and names one beneficiary (your revocable living trust.) If any of your assets are intentionally or inadvertently left out of your trust, your will scoops them up and pours them into your trust. This special will is called a “pour over will.”

I have a will. Do I still need a trust?

You may. That is a question that can only be answered after consultation with your estate planning attorney. A will is needed to name guardians of minor children. If you have a trust, you will still need the Will but it will be a special kind of will called a “Pour Over will” that works in conjunction with the trust. A will is only effective after you die and does not avoid probate. Many people seek to avoid probate because it is costly, time consuming, and a public process. A trust helps do that. The trust is also effective during your lifetime so it provides directions as to how your assets and your care should be handled should you become disabled.

Should I have a living will?

If you don’t want to remain hooked up to machines and would rather die peacefully, it is a good idea to have a living will. A living will allows you to make an important medical decision ahead of time. This document may direct your doctors to withhold medical treatment (i.e. medical heroics) at the very end of life.

Do I Lose Control Over My Assets if They are in a Trust?

NO! Not at all. Daily life with a Trust is simple. You are in complete control of your assets. You continue to invest as you wish, spend as you wish, and transfer or sell assets as you wish. The only change is the name on the accounts. The name (or title) on the account will be in the name of your trust instead of your individual name or joint name with another. This is called “funding.” You even still file your tax returns in exactly the same manner as you always have, using your social security number.

Is it Difficult to Transfer My Assets into the Trust?

It shouldn’t be. Your estate planning attorney, financial advisor, and insurance professional can help. Frequently it is as simple as filling out a form or sending a letter of request for the name change. This is called “funding.” Usually certain pages of your trust must be attached. Typically these pages show the name of the trust, trust revocability, the named trustees, and the signature pages. No private Trust information such as beneficiary names or assets lists need ever be shared to fund your Trust.

If I have a trust, will my estate go through probate?

It depends; if you have transferred your assets to a revocable living trust, your heirs will avoid probate. If you’re trust is not fully funded, probate is a possibility. In some cases there are ways to get assets “into” the trust, even if they were not properly added to the trust during life. However it is always best to make sure you retitle your assets in the name of your trust. The term “funded” refers to the re-titling of your assets into the name of your trust (instead of your individual name or joint names with your spouse.)

Why does it matter if my assets go through probate?

Probate is expensive, public, and time consuming. If you’re like most people, you like to keep your financial and family affairs private, save money, and get things done effectively and efficiently. A fully funded revocable living trust avoids probate.

If you have further estate planning questions, please feel free to call our estate planning law office: 858-792-5988. We look forward to hearing from you.

Ensure your legacy with a trust

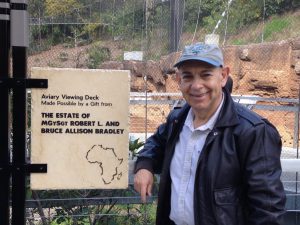

I was referred to MGySgt Robert Bradley, by another retired Marine several years ago. By the time I met Mr. Bradley, his wife Bruce was deceased (yes I know it’s the only woman I have ever known to have a first name Bruce). I was humbled to have been in Mr. Bradley’s presence. He fought bravely in the horrific battle of Guadalcanal, the first counter strike against the Axis in Pacific in the very early days of WWII. I am pleased that through the trust I wrote, his wishes to help the San Diego Zoological Society could be honored.